S'pore aims to rise up competitive ladder with R&D push, education thrust

Flush with a projected $6.4 billion surplus in FY2007, Singapore's latest Budget is set squarely on securing the country's place in the top league of global cities.

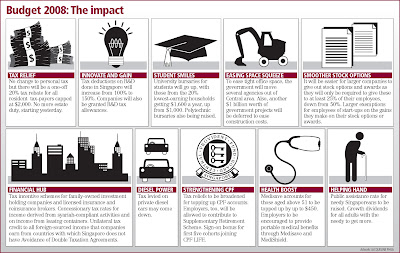

For those seeking immediate gratification, Finance Minister Tharman Shanmugaratnam did give, not the widely anticipated personal income tax cut but a 20 per cent rebate for Year of Assessment 2008, and some $1.8 billion worth of surplus-sharing 'dividends' and top-ups. And he finally abolished the estate duty.

But there's no mistaking the broader thrust of the government's financial policy and priorities, at this time of slowing global growth and rising inflation.

'This Budget is about how we are looking ahead to create new advantages and fresh opportunities for Singapore in a competitive world,' Mr Tharman Shanmugaratnam told Parliament yesterday as he announced a host of industry-specific tax incentives to keep business competitive - and particularly to turn Singapore into a research hub.

'We will help all our companies move up the innovation ladder,' he said, unveiling three schemes that will 'make Singapore one of the most competitive places for companies, big and small, to do R&D'.

These include increased tax deductions of 150 per cent for R&D done in Singapore, including forays into new areas unrelated to the company's existing activities.

The drive to 'make innovation pervasive in the economy' - which will extend to a new Chief Innovation Officer in each ministry - may not yield quick results and will likely have to be enhanced, Mr Tharman said. But he is confident it 'will eventually pay off'.

Another key plank of the Budget - invest more across all levels of education, and promote lifelong learning - is also geared towards producing a 'first- class workforce' in 'a world where we are competing on skills, quality and productivity, not on costs alone'.

Building capability and keeping the economy competitive is also a key part of the strategy to help Singaporeans cope with inflation, Mr Tharman said.

The main tool in moderating imported inflation is Singapore's exchange rate policy.

Had the Monetary Authority of Singapore not allowed the Sing dollar to appreciate over the past two years, the inflation rate in Q4 2007 would have averaged 6.5 per cent instead of 4.1 per cent, he disclosed.

Still, 'there is a limit to how fast the Singapore dollar can appreciate without hurting our economic performance and growth, and eventually causing wages to fall,' he pointed out.

Hence Singapore cannot be completely insulated from the effects of global inflation. But what is important is not to let domestic inflationary expectations set in, with wages rising to offset not only current but also future expected inflation, he said.

For now, Singapore has a budgetary windfall in hand, thanks to a robust economy and a property market boom that raked in record revenue for the 2007 fiscal year.

Stamp duties alone amounted to $3.8 billion - or $2.3 billion higher than expected. These large, extraordinary gains are not to be expected very often, Mr Tharman said. But the record inflows turned the FY2007 Budget balance around from an initial projected $0.7 billion deficit to a whopping $6.4 billion surplus.

For FY2008, a $0.8 billion deficit is projected, after special transfers of $5.4 billion for the young and old, as well as long-term old age needs.

Reactions to the Budget were somewhat mixed. While many hailed it as generous and balanced, others said it was 'cautious' and conservative, given the huge 2007 surplus.

There was a sense, particularly, that the Budget could have done more to ease business cost pressures. Says KPMG managing director Danny Teoh: 'Although the larger picture in relation to Singapore's competitiveness has been sketched out, businesses would probably have liked to see more immediate measures taken to alleviate the inflationary pressures on prices.'

He also thought the Budget is skewed towards SMEs - 'with most of the goodies appearing to go to them' - but 'falls short of the expectations of MNCs and big business'.

Meanwhile, Ajit Prabhu, tax partner at Deloitte Singapore, is still holding out for a cut in personal tax rates, which he said would have been 'a real icing on the cake'. He hopes to see it in upcoming Budgets.

But, for once perhaps, the so-called 'sandwich' middle-class is not left out. This group stands to gain most from the 20 per cent personal tax rebate, capped at $2,000, analysts point out.

For all the handouts, HSBC economist Robert Prior-Wandesforde reads the giveaways another way: The Budget 'may suggest that the government is more worried about Singapore's short-term growth prospects than the competitive threat posed by higher inflation and the risk of a mini wage-price spiral', he said. 'It's certainly a gamble.'

No comments:

Post a Comment